Your place to discuss the latest in Virginia construction law news and notes about the industry; both commercial and government construction.

VB CGC Practice Group

Vandeventer Black's Construction and Government Contracts Practice Group focuses on serving our business clients in the construction industry. We currently have offices in Norfolk and Richmond, VA, the OBX and Raleigh, NC, and Hamburg, Germany. For more information about Vandeventer Black, clink on the VB logo.

Tuesday, November 11, 2014

Thanks to All Veterans!

On this Veteran's Day 2014, Vandeventer Black LLP offers its thanks and gratitude to al of our veterans. Our lawyers have a solid history of military service, and we honor all how have and are serving in the different branches of service.

Wednesday, October 22, 2014

Virginia Mechanic's Liens - Deadline Overview

Below is a copy of a "cheat sheet" summary of important deadlines relating to Virginia mechanic's liens John Lockard and I prepared for a recent talk. Obviously not intended as a complete overview of mechanic's lien law, times or requirements; but a simple "keep in mind" overview.

Thursday, October 9, 2014

2014 Carter Gunn Memorial Stressbuster 8K - 27 Nov

Make your reservations now for the 2014 Carter Gunn Memorial Stressbuster 8K fun fun. This year the Stressbuster 8K is November 22, 2014 at First Landing State Park, Virginia Beach, VA. Registration starts at 7:30am; the race starts at 9:00am.

This is a fun, cross country 8K race along historic, scenic and rolling trails in First Landing State Park. The race is Chronotrack B-tag Timed.

All proceeds go to the Carter T. Gunn Fund, which is part of the Vandeventer Black Foundation. The Carter T. Gunn Fund is dedicated to fighting depression and educating the public about mental health.

More information about the Stressbuster 8K, including for registration or being a sponsor, is available at the following web link:

http://www.cartergunnstressbuster8k.mettleevents.com/

DOL Final Rule Raises Federal Contract Minimum Wage to $10.10 per hour

DOL issued its final rule on October 7 implementing President Obama's Executive Order 13,658 and increasing the minimum wage for workers performing federal service and construction contracts to $10.10 per hour. The final rule also sets future increases to be based upon the Consumer Price Index. More information about the final rule is available at the following DOL media web link:

http://www.dol.gov/opa/media/press/whd/WHD20141888.htm

http://www.dol.gov/opa/media/press/whd/WHD20141888.htm

Vandeventer Black Labor & Employment Law Seminar: November 18, 2014, Sheraton Norfolk Waterside Hotel

The Labor & Employment group of our firm is pleased to

announce its 29th annual Labor & Employment Law Review and

Update! The seminar will be held on November 18, 2014 at the Sheraton

Norfolk Waterside Hotel from

8:30 a.m. to 4:00 p.m. Topics Include: Recent

Developments in Labor & Employment Law • Affordable Care Act Updates •

Managing Employee Leave • Workers’

Compensation Tips • Hiring & Firing •

New Requirements for Government Contractors.

Please share the attached flyer with your clients.

Vandeventer

Black’s Labor & Employment team represents a wide variety of organizations

and businesses in labor and employment law and litigation matters, including

discrimination claims, union avoidance, NLRB charges, wrongful discharge,

breach of contract suits, trade secret/unfair competition suits, wage and hour,

employee benefits, workers’ compensation defense, immigration, and employee

relations counseling and training.

Tuesday, September 30, 2014

Federal Contruction Payment Requirements: A Thumbnail Overview

There are multiple layers and issues associated with payments for federal construction projects; both by agencies to contractors and by contractors to lower tiers. A thumbnail overview of the basic requirements are:

The underlying basic federal construction payment mandates

are in the Federal Prompt Payment Act (31 U.S.C. §§ 3901, et seq.) and FAR

Subpart 32.9, et seq. While having many aspects, the basic mandates are that payments

should be promptly made by both agencies to contractors and contractors (and

their lower tiers) to those of lower tier below them.

While there are more involved aspects, the short overview is

that payments are due by federal agencies: 1) on the date specified in the

contract; 2) in accordance with discount terms; 3) in accordance with

Accelerated Payment Methods; or – most typically – 4) 30 days after proper invoice.

When received, contractors then have 7 days to make payment

to their lower tiers (subcontractors and suppliers), and those lower tiers then

7 days to make payment to their lower tiers, and so forth. Those requirements

must be incorporated into all construction contracts.

However, the prompt payment requirements do still allow

certain withholdings, if: they are provided for in the contract; and relate to

retainage or relate to a withholding about which the contractor has given

notice to both the lower tier and the agency.

If contractors discover after their payment application but

before they make payment to their lower tiers that there is cause to withhold

payment from a lower tier, then they can withhold payments; but only if notice

has been furnished to the lower tier of the withholding cause, with copy to the

agency.

Payment must then be made to the lower tier as soon as

practicable after the withholding cause has been corrected (and within 7 days

of corrective action if agency has already made payment to the contractor or

alternatively within 7 days after payment to the contractor).

Of note, contractors may not request payment from agencies

for any amounts withheld or retained in accordance with contract rights until

such time as the contractor had determined, and certified to the agency, that

the subcontractor is entitled to payment. Of further note, false certifications

respecting payments by contractors are subject to other federal laws, including

the False Claims Act (31 U.S.C. §§ 3729, et seq.).

Tuesday, August 5, 2014

New "Fair Pay and Safe Workplace" Mandates Directed By President Obama

CONSTRUCTION

AND GOVERNMENT CONTRACT GROUP ALERT

Fair Pay and Safe Workplaces Executive Order Signed by

President Obama On July 31, 2014

On July 31, 2014, President Obama issued Executive Order

13673, entitled “Fair Pay and Safe Workplaces.” It is applicable to those

contracting with the Federal Government and its stated purpose is to insure

those contractors “understand and comply with labor laws.”

The Executive Order requires new pre- and post-contract

award actions by both agencies and contractors (and subcontractors), creates at

least one new senior agency official position, and requires regulatory

amendment consideration, including regarding consequences. Federal contractor

will need to develop implementation strategies to comply with this new EO.

Key aspects of EO 13673:

1. Pre-Award: For

offers exceeding $500,000, solicitations must include offer representations

regarding labor law violations within the preceding 3-year period.

Consideration of those representations will be part of responsibility

determinations. Contractors must similarly incorporate into their subcontracts

similar subcontractor disclosures.

2. Post-Award:

Contractors must update their labor law representations every 6 months during

contract performance. Contracting officers must then consider whether action is

necessary because of any changes to the representations (such as requiring

remedial measures, providing assistance, resolving issues, or in appropriate

instances termination or referral for suspension or debarment). Contractors

must similarly obtain updates from subcontractors, and then determine whether

action is necessary against their subcontractors based on those updates.

3. Labor

Compliance Advisors: Each agency is required to designate a senior agency

official as its Labor Compliance Advisor (LCA). The LCA have various duties,

including best practices interfaces, agency and contractor coordination, and assistance

to contracting officers regarding appropriate actions associated with EO’s

requirements.

4. Government-wide

Consistency: To help facilitate agency consistency regarding implementation,

the EO directs FAR Council consultation with the Department of Labor and other

key agencies to propose FAR amendments to implement the EO, including regarding

violation consequences. The EO further directs the Secretary of Labor to

develop guidance regarding EO implementation, including also regarding

violation consequences.

5. Paycheck

Transparency: This aspect of the EO requires contractors whose contracts are subject

to the pre- and post-award requirements discussed above to provide all individuals

performing work under their contracts and for whom they are required to

maintain wage records under applicable law (such as the Davis-Bacon Act, the

Service Contract Act or equivalent state law) with documented information

concerning that individual’s hours worked, overtime hours, pay, and any

additions made to or deductions from pay. Contractors much incorporate those

same requirements into their subcontracts for subcontractors to provide the

same information to their workers.

6. Complaint and

Dispute Transparency: This aspect of the EO limits contractor ability to

mandate arbitration of disputes. For all federal contracts that exceed $1

million, contractors must agree that the decision to arbitrate claims under

Title VII of the Civil Rights Act of 1964 or any tort related to or arising out

of sexual assault or harassment may only be made with the voluntary consent of

employees or independent contractors after such disputes arise. This same

requirement must be incorporated into subcontracts. Limited exceptions are: a)

contracts or subcontracts for the acquisition of commercial items or

commercially available off-the-shelf items; b) contractor or subcontractor

agreements covered by collective bargaining agreements; or c) contractor or

subcontractor agreements with valid arbitration provisions prior to bidding

upon a contract covered by the EO (but if such contracts allow for the changing

of terms, renegotiation or replacement, then the EO does apply).

Whether these terms are truly fair or will have any true

impact upon workplace safety will be in the eyes of affected persons and

companies. Regardless, the changes are significant, will required detailed

planning, and – unfortunately – are likely to be a significant source of future

litigation, and potentially detrimental administrative action for the unwary.

A copy of EO 13673 is currently available at the following White

House web-link:

For more information about EO 13673 or other construction or

government contracts related matters, please contact Neil Lowenstein, or any

other member of the Vandeventer Black Construction and Government Contracts

Group - VanBlackLaw.com.

Tuesday, July 22, 2014

President Issues Executive Order Banning Sexual Orientation and Gender Identity Discrimintation

On July 21, 2014, President Obama further amended Executive Order 11478 regarding Equal Employment Opportunity in the Federal Government by including the ban of sexual orientation or gender identity discrimination by federal contractors. The President resisted calls to carve out any exceptions for religion-affiliated employers; however, such employers may seek to challenge that. In any case, for now, the amendments add sexual orientation and gender identity to the list of classes of employees protected from discrimination by federal contractors. Long terms impacts of this remain to be seen.

The amendments can be found at the following White House web link:

http://www.whitehouse.gov/the-press-office/2014/07/21/executive-order-further-amendments-executive-order-11478-equal-employmen

The amendments can be found at the following White House web link:

http://www.whitehouse.gov/the-press-office/2014/07/21/executive-order-further-amendments-executive-order-11478-equal-employmen

Thursday, May 22, 2014

I'm Liable for What? - Employer Liability for Third Party Harassment

The recent U. S. Fourth Circuit Court of Appeals decision in Freeman v. Dal-Tile Corp., et al., decided April 29, 2014 adopts a negligence standard for an employer's liability for third party harassment under Title VII of the U. S. Code. As a result, the court in that case held that an employer can be held liable to its employees if the employer knows or should know of harassment by third parties, but fails to take "prompt remedial action reasonably calculated to end the harassment." As the court quipped, employer's cannot avoid liability by taking a "see no evil, hear no evil" strategy.

As noted in prior blogs, harassment of different levels is still not uncommon in the construction industry; and is clearly something to be avoided in any form. But this case serves as a warning shot that employers cannot just focus on their own employees harassing other employees; but also any third parties. Every day there are any number and types of third parties that intermix with construction employees, from those in the home office to those in the field. Such persons include vendors, inspectors, subcontractors, suppliers - the list goes on. The Freeman case illustrates the importance of employers taking any harassment claims seriously, and immediately nixing harassment, of any type and from any source, in the bud.

Follow Up: Since this post, I note that my law partner, Arlene Klinedinst - who focuses her practice on employment law - has been asked to comment about the Freeman case and has offered these thoughts:

1. The Freeman case puts the focus on the need for "prompt, meaningful action to stop the conduct."

2. Employers need to take a close look at supervisor authority, as that was not really addressed by the Freeman court, but can affect liability.

3. When responding to employee complaints of third party harassment, employers have to walk a fine line with responses. Employee transfers, even if promotions, can become issues.

4. For vendor or customer employees who are problems, employers should take decisive action, such as notifying the company president of the vendor / customer, and discussing options, including banning the offending visitor.

5. If the offending person will not stop, employers then have to take additional steps.

As noted in prior blogs, harassment of different levels is still not uncommon in the construction industry; and is clearly something to be avoided in any form. But this case serves as a warning shot that employers cannot just focus on their own employees harassing other employees; but also any third parties. Every day there are any number and types of third parties that intermix with construction employees, from those in the home office to those in the field. Such persons include vendors, inspectors, subcontractors, suppliers - the list goes on. The Freeman case illustrates the importance of employers taking any harassment claims seriously, and immediately nixing harassment, of any type and from any source, in the bud.

Follow Up: Since this post, I note that my law partner, Arlene Klinedinst - who focuses her practice on employment law - has been asked to comment about the Freeman case and has offered these thoughts:

1. The Freeman case puts the focus on the need for "prompt, meaningful action to stop the conduct."

2. Employers need to take a close look at supervisor authority, as that was not really addressed by the Freeman court, but can affect liability.

3. When responding to employee complaints of third party harassment, employers have to walk a fine line with responses. Employee transfers, even if promotions, can become issues.

4. For vendor or customer employees who are problems, employers should take decisive action, such as notifying the company president of the vendor / customer, and discussing options, including banning the offending visitor.

5. If the offending person will not stop, employers then have to take additional steps.

Friday, May 2, 2014

Contractual Indemnity Provisions: Certain Provisions in Construction Contracts Void

As many know, construction contract indemnity provisions are one of the few examples of Virginia not strictly holding parties to their contracts because of the statutory override in Virginia Code Sec. 11-41. Discussing some related issues within our Construction Department reminded me of a very good summary of the issues prepared by my law partner, Pat Genzler, summarizing the Virginia Supreme Court's 2011 review of the issue in Uniwest Construction, Inc. v. Amtech Elevator Services, Inc., 280 Va. 428, 699 S.E.2d 223 (2010), modified on rehearing 281 Va. 509, 714 S.E.2d 560 (2011). I have included Pat's summary below:

CONTRACTUAL

INDEMNIFICATION AND THE “UNIWEST v. AMTECH” CASE

Pat Genzler, Vandeventer

Black LLP

1.

As a general

rule, Virginia is one of states that generally allows

parties to contractually obtain indemnification for losses and claims caused by

the indemnitee’s own negligence, so long as the indemnity provision is clear

and explicit. Estes Exp. Lines, Inc. v. Chopper Exp. Inc.,

273 Va. 358, 641 S.E.2d 476 (2007). In

the Estes case, the Virginia Court held that it was not against public policy

of Virginia for parties to “… pre-determine how potential losses incurred

during the course of a contractual relationship will be distributed between the

potentially liable parties.” The Court

held that agreements to indemnify a party against claims for personal injury or

property damage, even to the extent of the indemnitee’s own negligence, were

not against public policy and were enforceable.

2.

However, the general rule allowing contractual indemnity

agreements that will indemnify an indemnitee for its own negligence has been

limited or abolished for most construction-related contracts. Va. Code §11-4.1

provides:

§ 11-4.1. Certain indemnification

provisions in construction contracts declared void.

Any provision contained in any contract relating to the construction,

alteration, repair or maintenance of a building, structure or appurtenance

thereto, including moving, demolition and excavation connected therewith, or

any provision contained in any contract relating to the construction of

projects other than buildings by which the contractor performing such work

purports to indemnify or hold harmless another party to the contract against

liability for damage arising out of bodily injury to persons or damage to

property suffered in the course of performance of the contract, caused by or

resulting solely from the negligence of such other party or his agents or

employees, is against public policy and is void and unenforceable. This section

applies to such contracts between contractors and any public body, as defined

in § 2.2-4301.

This section shall not affect the validity of any insurance contract,

workers' compensation, or any agreement issued by an admitted insurer.

In Uniwest Construction,

Inc. v Amtech Elevator Services, Inc., 280 Va. 428, 699 S.E.2d 223 (2010),

modified on rehearing 281 Va. 509, 714 S.E.2d 560 (2011), the Supreme Court

reviewed both the express indemnity provisions in a subcontract, and those

indemnity provisions in the general contract of construction that were “flowed

down” or incorporated into the subcontract by reference. The case arose when one employee of an

elevator installation subcontractor was killed, and another injured, and the

estate of the deceased man and the injured man sued the general contractor in

negligence. The Supreme Court held that

(a)

An indemnity agreement arising out of a construction

contract that purports to indemnify or hold a party harmless for a claim due to

the indemnitee’s own negligence – whether the sole cause or partial cause of

the injury -- is void pursuant to §11-4.1. [1]

(b)

If the indemnification language in the clause violates

§11-4.1, the entire clause was void. The Court would not rewrite or “carve out” of the clause

the offending language, so as to leave those provisions that did not violate

§11-4.1. Thus, an indemnity provision

that violates §11-4.1 is likely to be void in its entirety.

(c)

A broad and general “flow down” of the prime construction

contract into a subcontract[2]

was broad enough to flow down the general contractor’s obligation to indemnify

the owner, into the subcontract, obligating the subcontractor to indemnify the

general contractor to the same extent. Thus, even if the specific indemnity clause in the subcontract

was void, the indemnification provisions of the general contract of

construction, including its indemnity provisions, did not violate §11-4.1 and

therefore obligated the subcontractor to indemnify the general contractor for

the claims made by the subcontractor’s employees.

3.

The Uniwest

case also illustrates some of real risks in broad indemnity agreements and flow

down provisions. Ultimately the dispute

was about insurance coverage, and whether the subcontractor, Amwest, was

obligated to include the general contractor, Uniwest, as an additional insured

on the subcontractor’s general liability and umbrella liability policies. The contract

specifications required the subcontractor to name the general contractor as an

additional insured under its liability insurance policies. Ultimately even though Uniwest was not expressly

named as an additional insured on the general

liability insurance policy, an endorsement to the policy granted “additional

insured status” to any indemnified party.

Further, the umbrella liability policy also extended additional insured

status to any person who was required to be insured by the underlying general

liability policy. However, this decision turned on the specific

language of the policies, and in other circumstances, there could very well be

no coverage for an assumed indemnification obligation.

CONCLUSION

The

Uniwest case is the Supreme Court’s

most recent decision on the validity of indemnification agreements on

construction contracts and so we must regard the decision as the latest

statement of the law. Clearly, any

indemnification clause in a construction contract that expressly purports to

indemnify another party for damages arising from the indemnitee’s own

negligence - whether the sole cause of

the loss or a partial cause -- is likely to be found void under Va. Code

§11-4.1.

Another

question is whether you can “draft around” this issue by simply saying that the

subcontractor will indemnify the general contractor “… to the maximum extent

permitted by law …” or “consistent with applicable law.” Such clauses have been upheld in some cases,

but each clause stands on its own.

Finally,

the area where there is real cause for concern is the effect of insurance

coverage and broad flow down provisions in subcontracts on the subcontractor’s

indemnity obligations. Without careful

reading of the general contract (“prime contract”) and a review of the

insurance policies, a subcontractor can be put into the situation of having to

honor an unexpected indemnity obligation, and one that is not insured.

[1] The

void indemnity agreement stated:

[Subcontractor]

hereby assumes entire responsibility for any and all damage or injury of any

kind or nature whatever, including death resulting therefrom, to all persons,

whether employees of [Subcontractor], its subcontractors or agents. If any

claims for such damage or injury be made or asserted, whether or not such

claim(s) are based upon the negligence of General Contractor or [Owner], [Subcontractor]

agrees to indemnify and save harmless General Contractor from any and all such

claims, and further from any and all loss, costs, expense, liability, damage or

injury, including legal fees and disbursements, that General Contractor may

sustain, suffer or incur as a result thereof. Further [Subcontractor]

agrees to and does hereby assume the defense of any action at law or in equity

which may be brought against General Contractor or [Owner] arising by reason of

such claims.

[2] The

flow down provision stated:

[Amtech] agrees to be bound to Uniwest by all the terms of the

[Prime Contract] and to assume towards Uniwest all of the obligations and

responsibilities that Uniwest has by the [Prime Contract] assumed toward

[Owner]. All terms and conditions contained in the [Prime Contract] which, by

the [Prime Contract] or by operation of law, are required to be placed in [the]

Subcontract[ ] are hereby incorporated herein as if they were specifically

written herein.

The Prime Contract contained the following indemnity language, which

the Court held obligated the Subcontractor to indemnify the General Contractor:

[Prime Contractor shall indemnify Owner to] the fullest extent

permitted by law ... from and against claims, damages, losses and expenses,

including but not limited to attorneys’ fees, arising out of or resulting from

performance of the Work, provided that such claim, damage, loss or expense is

attributable to bodily injury, sickness, disease or death, or injury to or

destruction of tangible property, (other than the Work itself) including loss

of use resulting therefrom, but only to the extent caused in whole or in

part by negligent acts or omissions of [Prime Contractor], a Subcontractor,

anyone directly or indirectly employed by them or anyone for whose acts they

may be liable, regardless of whether or not such claim, damage, loss or

expense is caused in part by a party indemnified hereunder.

Thursday, May 1, 2014

Contractor's Construction Fraud Implied

It is not unusual for a contractor to obtain any advance for construction work or materials. While that is done more often with residential construction, it is also done on some commercial projects or with individual subcontractors. What if they don't then follow through? Virginia makes "construction fraud" a crime, and in the recent appellate decision of Dennos v. Commonwealth of Virginia, 63 Va.App. 139, 754 S.E.2d 913 (2014) the Virginia Court of Appeals discussed the state's burden of proof and the application of the single larceny doctrine.

First, what does the construction fraud statute say? Here's the text:

§ 18.2-200.1. Failure to perform promise for construction, etc., in return for advances.

If any person obtain from another an advance of money, merchandise or other thing, of value, with fraudulent intent, upon a promise to perform construction, removal, repair or improvement of any building or structure permanently annexed to real property, or any other improvements to such real property, including horticulture, nursery or forest products, and fail or refuse to perform such promise, and also fail to substantially make good such advance, he shall be deemed guilty of the larceny of such money, merchandise or other thing if he fails to return such advance within fifteen days of a request to do so sent by certified mail, return receipt requested, to his last known address or to the address listed in the contract.

First, regarding proof of the construction fraud:

- The court confirmed that fraudulent intent can be inferred from conduct and representations of the contractor. In that case, the defendant fraudulently promised to do certain work (he took money but then never bought materials or performed work) and also fraudulently misrepresented the required work scope (telling the owner the roof needed replacement when it only needed repair).

- The court discussed that while the fraudulent intent must have existed at the time the contractor made the misrepresentations (in that case took the advance), circumstances were sufficient to imply the fraud, including the subsequent failure to perform the work, the failure to use the advanced funds to purchase supplies or hire needed labor and the refusal to return the advanced funds.

The court reviewed the evidence presented and found "ample evidence from which a rational factfinder could conclude that [the contractor] committed construction fraud . . . ,"

Second, regarding the single-larceny doctrine:

- The court noted the continuing applicability of that "common law" doctrine, as being one of the principles older than the Commonwealth itself, and which for some cases benefits prosecutors and for others defendants.

- The court held that the standard for applying the doctrine required that the series of larcenous acts have been done pursuant to a single impulse and in execution of a general fraudulent scheme; and so the doctrine does not apply to larcenous acts that are part of a general scheme but not individually the product of a single impulse.

The court reviewed the evidence and, giving the required deference to the factfinder, concluded that the contractor in that case committed at least two larcenous acts that were not done pursuant to a single impulse and execution of a general fraudulent scheme. Specifically, the contractor procured two separate advances on two separate dates involving two different promises. Thus, he could probably be charged and convicted respecting both.

The Virginia construction industry is overall extremely professional, but there are some "bad seeds" with any group as big as the contractor community; and this lesson provides guidance regarding the ramifications for fraudulent construction, and associated rights of the public.

First, what does the construction fraud statute say? Here's the text:

§ 18.2-200.1. Failure to perform promise for construction, etc., in return for advances.

If any person obtain from another an advance of money, merchandise or other thing, of value, with fraudulent intent, upon a promise to perform construction, removal, repair or improvement of any building or structure permanently annexed to real property, or any other improvements to such real property, including horticulture, nursery or forest products, and fail or refuse to perform such promise, and also fail to substantially make good such advance, he shall be deemed guilty of the larceny of such money, merchandise or other thing if he fails to return such advance within fifteen days of a request to do so sent by certified mail, return receipt requested, to his last known address or to the address listed in the contract.

First, regarding proof of the construction fraud:

- The court confirmed that fraudulent intent can be inferred from conduct and representations of the contractor. In that case, the defendant fraudulently promised to do certain work (he took money but then never bought materials or performed work) and also fraudulently misrepresented the required work scope (telling the owner the roof needed replacement when it only needed repair).

- The court discussed that while the fraudulent intent must have existed at the time the contractor made the misrepresentations (in that case took the advance), circumstances were sufficient to imply the fraud, including the subsequent failure to perform the work, the failure to use the advanced funds to purchase supplies or hire needed labor and the refusal to return the advanced funds.

The court reviewed the evidence presented and found "ample evidence from which a rational factfinder could conclude that [the contractor] committed construction fraud . . . ,"

Second, regarding the single-larceny doctrine:

- The court noted the continuing applicability of that "common law" doctrine, as being one of the principles older than the Commonwealth itself, and which for some cases benefits prosecutors and for others defendants.

- The court held that the standard for applying the doctrine required that the series of larcenous acts have been done pursuant to a single impulse and in execution of a general fraudulent scheme; and so the doctrine does not apply to larcenous acts that are part of a general scheme but not individually the product of a single impulse.

The court reviewed the evidence and, giving the required deference to the factfinder, concluded that the contractor in that case committed at least two larcenous acts that were not done pursuant to a single impulse and execution of a general fraudulent scheme. Specifically, the contractor procured two separate advances on two separate dates involving two different promises. Thus, he could probably be charged and convicted respecting both.

The Virginia construction industry is overall extremely professional, but there are some "bad seeds" with any group as big as the contractor community; and this lesson provides guidance regarding the ramifications for fraudulent construction, and associated rights of the public.

Disclosure of Investigation Documents Granted for Qui Tam Realtor

My law partner Mike Sterling forwarded this summary of a recent qui tam movant's motion to compel contractors to product documents relating to their codes of business conduct investigations. It's an important issue for any government contractor. Here's Mike's summary:

Recently, the District Court for the District of Columbia

granted a qui tam relator’s motion to compel contractors to produce

documents relating to the contractor’s code of business conduct investigations.

United

States ex rel. Barko v. Halliburton Co., No. 1:05-cv-1276 (D.D.C. Mar. 6, 2014)

According to the court, neither the attorney-client privilege nor the work

product doctrine prevented disclosure. The relator sought almost 100 documents

related to internal audit and fraud investigations conducted by one of the

contractors. The disputed documents, were reviewed by the court reviewed in

camera and described as "eye-openers.” The documents showed that a

subcontractor received preferential treatment and evidence of pay-offs from the

subcontractor to steer business to the company. Also, the subcontractor

continued to receive subcontracts despite unsatisfactory performance, failure

to complete projects and repeated double-billing. Investigation documents can

be protected from disclosure only under certain circumstances. The court will

consider several factors including the existence of a written code of business

conduct that is followed by the company, a request for legal advice, attorney

oversight of the investigation, written instructions from the attorney to any

investigators, Upjon Warnings to all current and former employees explaining

that the interviews are for the purpose of providing legal advice to the

company, restrictive labels on documents, reports addressed to the attorney and

a documented threat of litigation. Every company should have a written code of

business conduct, and investigations should be planned with care.

Thursday, April 10, 2014

Employee Bound By Arbitration Agreement in Employment Application

Last month Judge Conrad of the Western District of Virginia held that an employee was required to arbitrate his claims because the employees signed an employment application agreeing if employed to be bound by the company's Dispute Resolution Process (DRP), which included arbitration. The employee had denied signing the DRP agreement itself, but admitted he signed the employment application referencing it. In addition to finding the employment application was an agreement to arbitrate, Judge Conrad rejected the employee's arguments that: 1) the DRP violated either the National Labor Relations Act (NLRA) or the Norris-LaGuardia Act of 1932 (NLGA); 2) the arbitration agreement was unconscionable; or 3) the arbitration agreement was a contract of adhesion. While all arbitration agreements stand or fall on individual verbiage and facts, this case provides helpful guidance to employers on developing enforceable and binding arbitration agreements for its employees, and in particular establishing binding arbitration as early as the employment application itself.

Monday, April 7, 2014

Fourth Circuit Upholds Dismissal of EEOC Claims and EEOC's Obligation to Pay Attorneys Fees

The Fourth Circuit Court of Appeals recently provided a warning case to the United States Equal Employment Opportunity Commission (EEOC) about better vetting suits against employers, and acting timely for those the EEOC deems with merit. In the recently decided appeal of EEOC v. Porpoak Logistics, Inc., decided March 25, 2014 (4th Cir. Appeal No. 13-1687), the Fourth Circuit affirmed the district court's dismissal of an EEOC suit filed some six and a half years after the originally filed discrimination charges, finding that the employer had been unfairly prejudiced by the EEOC's delay. The Fourth Circuit also upheld the district court's award to the employer of its attorney's fees.

Among other things, because of the delay, important witnesses were no longer available or had "faded memories" and the company had already destroyed important documents during routine document destruction. Additionally, there were questionable underlying merits to the claim itself. While the EEOC defended its actions in part on its overburdened staff, the Fourth Circuit wholly rejected that as a defense, with one of the justices noting that private companies would not even dream about arguing such a defense to explain misconduct.

Certainly the EEOC performs necessary, important functions; but the Porpoak decision should help ensure that in performing those functions the EEOC gives greater consideration to only pursuing fully vetted claims, and if it chooses to pursue them then doing so promptly.

Among other things, because of the delay, important witnesses were no longer available or had "faded memories" and the company had already destroyed important documents during routine document destruction. Additionally, there were questionable underlying merits to the claim itself. While the EEOC defended its actions in part on its overburdened staff, the Fourth Circuit wholly rejected that as a defense, with one of the justices noting that private companies would not even dream about arguing such a defense to explain misconduct.

Certainly the EEOC performs necessary, important functions; but the Porpoak decision should help ensure that in performing those functions the EEOC gives greater consideration to only pursuing fully vetted claims, and if it chooses to pursue them then doing so promptly.

Thursday, March 13, 2014

Carnell Construction: Major Virginia Procurement Decision Issued by U.S. Fourth Circuit Affecting Claim Recovery Under VPPA

Last week the United States Court of Appeals for the Fourth Circuit issued a decision in the Case of Carnell Construction Corp. v. Danville Redevelopment & Housing Authority with significant implication regarding Virginia Public Procurement Act (VPPA) claims. The case has a detailed history and has been sent back to the lower court for the fourth time. While it has an important holding regarding contractor discrimination claims that adopts the ability of entities, and not just individuals, to make discrimination based claims, in many ways the holdings affecting the contractor's VPPA claims are likely to have more significant implications for all contractors performing Virginia public body work. Below is a Legal Developments summary regarding the latest Carnell decision prepared by the Vandeventer Black Construction and Public Contracts Team:

Tuesday, February 25, 2014

GAO Decides Offeror Affiliates Should be Considered in Experience Evaluation

The Government Accountability Office recently considered whether a offeror's affiliate companies should be considered by the government in evaluating the offeror's experience in Iyabak Constr. LLC, GAO, B-409196, 2/6/14, decision released 2/11/14. The solicitation should past performance experience for similar projects within the last five years, but experience examples were limited to projects performed by the firms submitting the offers and the government did not consider Iyabak's affiliates experiences. Iyabak protested and the GAO decided that the restrictions imposed were unnecessary, recommending the government's modification of the RFP to consider the experience and past performance of offerors' affiliates showing a firm commitment to be meaningfully involved in contract performance (but noting it would be improper to consider affiliates that were not going to be meaningfully involved).

Thursday, February 13, 2014

President Unilaterally Raises Minimum Wage for Federal Contracts

On February 12, 2014, President Obama signed his promised Executive Order increasing the minimum wage to $10.10 per hour for workers under new and renegotiated federal contracts. The Executive Order also increases the minimum wage for tipped workers starting January 1, 2015. The new wage rates will raise with inflation each year. Covered workers include those in the construction and service industries.

The related issues are many; but two immediate concerns for employers are: 1) the likelihood that workers on different projects / contracts will have different wages; and 2) contractors may be forced to raise the pay of workers whose wages are at or near $10 an hour to maintain the differential from newer or less skilled employees.

Contractors with unionized workforces tied to the minimum wage may be forced to renegotiate collective bargaining agreements. How else this will indirectly affect the construction and service industries remains to be seen.

The related issues are many; but two immediate concerns for employers are: 1) the likelihood that workers on different projects / contracts will have different wages; and 2) contractors may be forced to raise the pay of workers whose wages are at or near $10 an hour to maintain the differential from newer or less skilled employees.

Contractors with unionized workforces tied to the minimum wage may be forced to renegotiate collective bargaining agreements. How else this will indirectly affect the construction and service industries remains to be seen.

Friday, January 10, 2014

Party Relationships: Contract Form Can Dictate

When parties go into relationships they often think the relationship is one thing; but legally the relationship may be another. Judge Hughes' recent decision in the case of PEAC Consulting, LLC v. The Ridley Group & Associates, et al., decided September 20, 2013 (CL12-4821, Richmond Circuit Court) emphasizes the importance to the relationship question of the documents and titles actually used by the parties themselves when they create the relationship. In that case, the plaintiff claimed there was a joint venture relationship with another company in seeking award of a public procurement; however, the trial court disagreed because the proposal that was submitted to the public body identified the parties as "two primary subcontractors." While the court allowed plaintiff's claims to proceeds on other basis, the distinction between joint venturers and subcontractors can be significant; particularly with respect to rights, obligations, and damages. Bottom line, what you call yourself matters, so carefully chose your words, and seek appropriate legal counsel regarding the legal consequences, advantages, and disadvantages of what you could or do choose.

Monday, January 6, 2014

Oh Oh . . . Did I Really Just Waive My Coverage?

Incidents are common place on construction sites. Unfortunately, sometimes things happen that damage the work or cause injury. Typically there is insurance coverage that covers these incidents, but a recent Federal Court decision highlights the pitfalls to the insured taking unilateral action to resolve associated claims, if the insured intends to pursue a related claim against the insurance carrier.

That case is the Fourth Circuit Court of Appeals decision decided on December 16, 2013, Case No. 12-2415 in Perini/Thompkins Joint Venture v. ACE American Insurance Company. The JV was the construction manager for that project. The owner had purchased Owner Controlled Insurance through ACE. The JV was an additional insured under that policy.

During construction a 2,400 ton glass atrium was damage. The JV incurred significant related monetary losses for the damages, and also the related time impacts. Related project litigation ensued between the JV and the owner, that eventually resulted in a settlement of the JV's claims. The JV did not notify ACE of that lawsuit or the settlement until after the settlement.

Six months after the settlement, and nearly two years after the collapse, the JV send a demand letter to ACE advising that to the extent the JV's builder's risk carrier did not pay the JV's collapse related claim then the JV expected ACE to pay. That letter was the first formal written demand to ACE by the JV. Eventually the JV sued ACE and ACE moved to dismiss on the grounds the JV settled the underlying claim without prior notice to ACE.

Applying MD law, but at its basic level merely interpreting the insurance contract as written, the Fourth Circuit held the JV waived any coverage claims against ACE by settling its underlying claim with the owner without first notifying ACE, and that ACE had not intentionally relinquished its rights under that contract by any of its related acts or omissions.

While facts and policy language will differ, the basic premise of this case stands as a warning to those who are contemplating a contractual settlement of claims when those same claims might also have associated insurance claims. Bottom line, ignore insurance policies and insurers at one's peril.

That case is the Fourth Circuit Court of Appeals decision decided on December 16, 2013, Case No. 12-2415 in Perini/Thompkins Joint Venture v. ACE American Insurance Company. The JV was the construction manager for that project. The owner had purchased Owner Controlled Insurance through ACE. The JV was an additional insured under that policy.

During construction a 2,400 ton glass atrium was damage. The JV incurred significant related monetary losses for the damages, and also the related time impacts. Related project litigation ensued between the JV and the owner, that eventually resulted in a settlement of the JV's claims. The JV did not notify ACE of that lawsuit or the settlement until after the settlement.

Six months after the settlement, and nearly two years after the collapse, the JV send a demand letter to ACE advising that to the extent the JV's builder's risk carrier did not pay the JV's collapse related claim then the JV expected ACE to pay. That letter was the first formal written demand to ACE by the JV. Eventually the JV sued ACE and ACE moved to dismiss on the grounds the JV settled the underlying claim without prior notice to ACE.

Applying MD law, but at its basic level merely interpreting the insurance contract as written, the Fourth Circuit held the JV waived any coverage claims against ACE by settling its underlying claim with the owner without first notifying ACE, and that ACE had not intentionally relinquished its rights under that contract by any of its related acts or omissions.

While facts and policy language will differ, the basic premise of this case stands as a warning to those who are contemplating a contractual settlement of claims when those same claims might also have associated insurance claims. Bottom line, ignore insurance policies and insurers at one's peril.

Friday, January 3, 2014

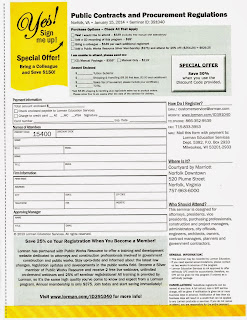

Vandeventer Black's Lowenstein Teaching Upcoming Public Contracts and Procurement Regulations Seminar

Vandeventer Black's Neil Lowenstein is one of the teachers for an upcoming seminar on January 15, 2014 in Norfolk, VA addressing Public Contracts and Procurement Regulations in Virginia. Part of Neil's presentation is a section on procurement ethical issues as well as common dispute issues. The seminar is at the Marriott Courtyard in Downtown Norfolk. More information about this program is in the brochure below, or you can contact Neil:

Fourth Circuit Affirms Dismissal of Suit for Discovery Failings

In its recent decision in Projects Management Co. v. DynaCorp International LLC, __ F.3d ___ 122241 (4th Cir., No. 12-2241, Decided November 5, 2013), the Fourth Circuit Court of Appeals re-iterated the importance of meeting pre-trial discovery requirements in affirming the lower court's dismissal of a multi-million dollar damage claims because of the plaintiff's discovery failings, including non- and late production of documents.

While the plaintiff argued dismissal was too extreme and lesser sanctions were available, the Fourth Circuit concluded the district judge's dismissal decision was not clearly erroneous or an abuse of the judge's discretion, and therefore sustained the dismissal. This case re-iterates the importance of complying with pre-trial discovery obligations, and offers additional insights to the Fourth Circuit's review on appeal of related decisions.

First, the Fourth Circuit re-iterated the review standard as abuse of discretion. Since district courts have so much discretion in addressing their dockets and matters before them, this is a very tough standard to overcome on appeal. Second, the Fourth Circuit addressed the factors for consideration before a dismissal; which are: 1) degree of wrongdoer's culpability; 2) extent of the client's blameworthiness if wrongful conduct committed by its attorney; 3) prejudice to the judicial process and the administration of justice; 4) prejudice to the victim; 5) availability of other sanctions; and 6) the public interest.

The court noted that the district judge's evaluation of these factors stands unless clearly erroneous. The court further noted that in exercising the related discretion the district court can act of its of volition (sua sponte) and must consider the whole of the case in choosing the appropriate sanction. That latter was part of the decision because the district judge had based his decision on matters beyond those addressed in the related briefs, which the court confirmed was not just appropriate, but required.

While the abuses in this case were severe, it demonstrates the importance for clients to understand the role of pre-trial discovery and breadth of the district court's discretion, and role, in insuring discovery compliance and the fairness of the judicial process.

While the plaintiff argued dismissal was too extreme and lesser sanctions were available, the Fourth Circuit concluded the district judge's dismissal decision was not clearly erroneous or an abuse of the judge's discretion, and therefore sustained the dismissal. This case re-iterates the importance of complying with pre-trial discovery obligations, and offers additional insights to the Fourth Circuit's review on appeal of related decisions.

First, the Fourth Circuit re-iterated the review standard as abuse of discretion. Since district courts have so much discretion in addressing their dockets and matters before them, this is a very tough standard to overcome on appeal. Second, the Fourth Circuit addressed the factors for consideration before a dismissal; which are: 1) degree of wrongdoer's culpability; 2) extent of the client's blameworthiness if wrongful conduct committed by its attorney; 3) prejudice to the judicial process and the administration of justice; 4) prejudice to the victim; 5) availability of other sanctions; and 6) the public interest.

The court noted that the district judge's evaluation of these factors stands unless clearly erroneous. The court further noted that in exercising the related discretion the district court can act of its of volition (sua sponte) and must consider the whole of the case in choosing the appropriate sanction. That latter was part of the decision because the district judge had based his decision on matters beyond those addressed in the related briefs, which the court confirmed was not just appropriate, but required.

While the abuses in this case were severe, it demonstrates the importance for clients to understand the role of pre-trial discovery and breadth of the district court's discretion, and role, in insuring discovery compliance and the fairness of the judicial process.

Subscribe to:

Posts (Atom)

.jpg)

_Page_1.tif)

_Page_2.tif)

_Page_3.tif)

_Page_4.tif)